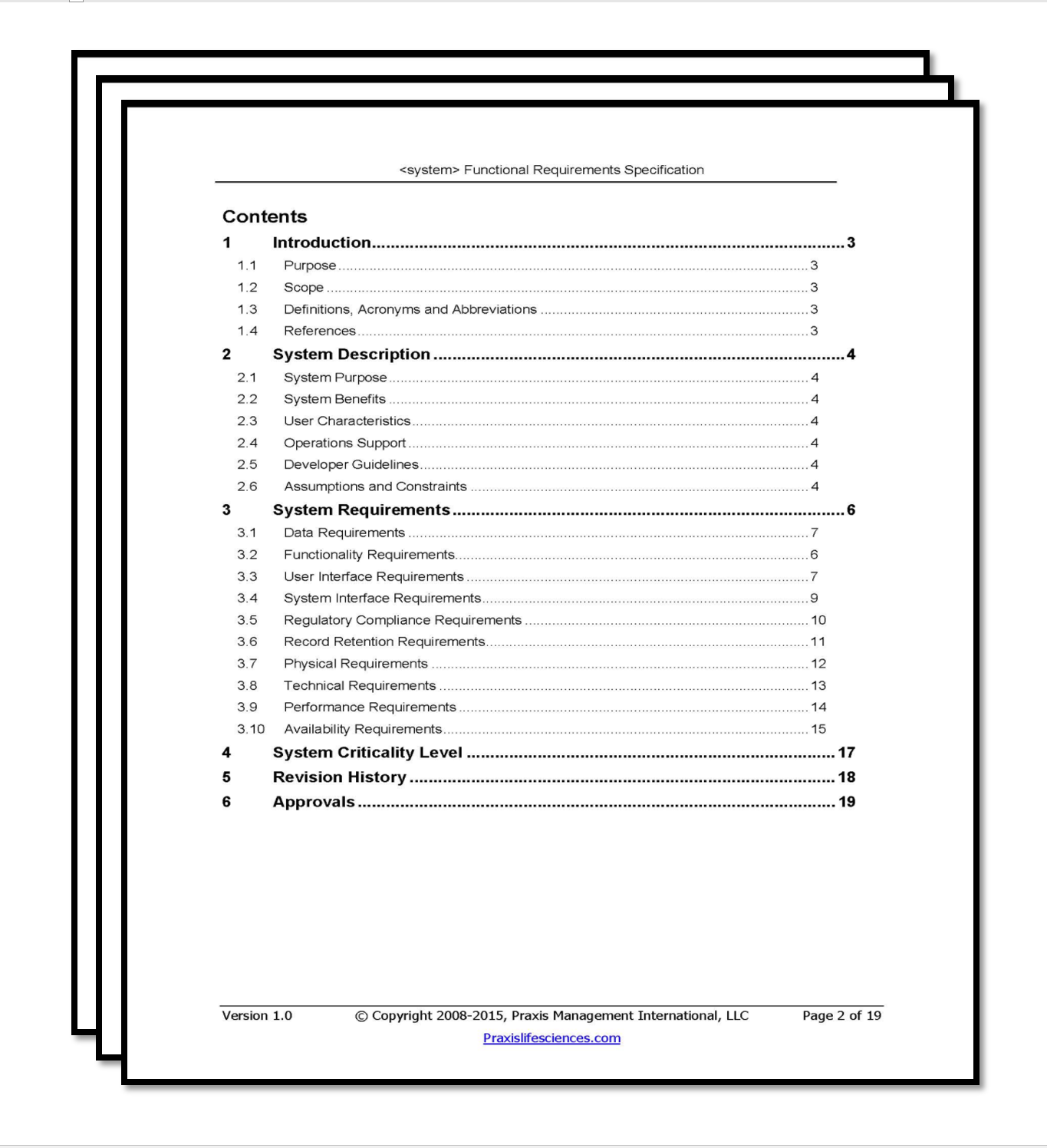

Table Of Content

Your down payment is a large, one-time payment toward a home purchase. Many home buyers believe they need a 20% down payment to buy a home, but this isn’t true. Plus, a down payment of that size isn’t realistic for many first-time home buyers. Fortunately, buyers who can’t afford a 20% down payment have several options, depending on the loan type. If you’re a first-time home buyer or haven’t owned a primary residence in the last 3 years, you may qualify for state programs, grants and federal loan programs. The more you educate yourself on how to qualify for a first-time home buyer loan, the easier the home buying process will be.

First-time homebuyers in California

Remember to keep your lender in the loop to make sure they’ll accept the program. There’s no minimum income to get a mortgage, but some loan programs have a maximum income limit. This applies to self-employed mortgage borrowers, too, in which case you’ll provide your business and personal tax returns for the previous two years.

Is There A First-Time Home Buyer Tax Credit?

The seller or the agent is required to provide written evidence of the present smoke detectors. Your down payment is one way mortgage lenders can assess your finances, establish your creditworthiness and verify that you can repay your loan. A down payment proves to a lender that you’re serious about buying a home and willing to invest your money into the property. It takes about 30 days to get a mortgage in a normal market — or 45 to 60 days during high-volume months — depending on the lender.

Debt-to-Income (DTI) Ratio

How Much Is A Down Payment On A House? - Bankrate.com

How Much Is A Down Payment On A House?.

Posted: Tue, 09 Apr 2024 07:00:00 GMT [source]

The U.S. Department of Agriculture (USDA) has its own home loan program that assists lower and moderate-income people to obtain decent homes in rural areas. That also will allow you to skip private mortgage insurance, which adds to your monthly costs down the road. Eighty-six percent of people who bought a home in 2022 said they found a real estate agent to be useful in the process. Many states offer down payment assistance programs to qualified buyers, so research whether any assistance is available to make your home purchase more affordable. The amount you’ll need for a down payment depends on your loan type and how much you borrow. If a down payment is required, you can buy a home with as little as 3% down (although putting down more has benefits).

Although, mortgage rates tend to be significantly higher for these types of special considerations. Believe it or not, you don’t need excellent credit to get a mortgage. Different homebuyer programs have different credit requirements, and sometimes you can qualify with a credit score as low as 580.

Looking for a tee time? Here are 9 pleasant public golf courses in L.A.

When it comes to your financial history, lenders are simply looking for a pattern of paying bills mostly on time. You can go it alone, but finding a real estate agent who is experienced and knowledgeable can be key to, well, getting you a new set of house keys. Before you go home shopping, it can be wise to get a pre-approval letter from a lender or a few lenders. You submit some credentials that share financial information, and the lender says that you likely qualify for a loan of a certain amount. In 2019, a California real estate law was created to protect victims of domestic abuse. According to the new law, it’s illegal for a landlord to take any type of vindictive action or threaten tenants when they make an emergency 911 call.

Are you ready to get started?

Keep in mind that a lower credit score often means paying a higher mortgage rate. Because the government guarantees a portion of the loans, they’re less risky for lenders to approve. Lenders are typically more willing to issue lower-than-average interest rates and offer more relaxed down payment requirements. The 20% down payment recommendation can make homeownership feel unrealistic – but the good news is that very few lenders require 20% at closing.

When you decide to make an offer on a home, you must submit an offer letter. Your agent will almost always write the offer letter on your behalf, but you can write it yourself if you choose. Your offer letter will include details about you (like your name and current address) and the price you’re willing to pay for the home. Your real estate agent will help you hunt for houses within your budget. It’s a good idea to make a list of your top priorities, some of which might depend on the type of house you’re looking for and whether you’re in search of a starter home or a forever home. Once you decide you’re ready to buy a home, it’s time to set a budget.

Table Of Contents

We recommend that you review the privacy policy of the site you are entering. SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website. A three-day notice bill was introduced as a new California real estate law in 2019. This bill changed the notice period to exclude judicial holidays, including Saturday and Sunday. The main goal of the law is to protect tenants from getting evicted unfairly. Homeowners are prohibited from enforcing or restricting the display of religious items on a property door.

Department of Agriculture (USDA) and don’t have an industry-standard credit score requirement. However, most lenders require a minimum credit score of 640 for USDA loans. If you have a median score of 580 and your co-borrower on the loan has a 720 credit score, the average credit score would be 650. Because the minimum qualifying score for conventional loans is 620, this can mean the difference between qualifying for a mortgage and not.

Bring your ID, a copy of your Closing Disclosure and proof of funds for your closing costs. Three business days before closing, your lender is required to provide you with your Closing Disclosure, which tells you what you need to pay at closing and summarizes your loan details. Look over your Closing Disclosure carefully to know what to expect and catch any errors. Homeownership comes with several costs that don’t apply to renters. For example, you’ll need to pay property taxes and maintain some form of homeowners insurance. Factor these expenses into your household budget when determining how much house you can afford.

In addition, a significant percentage put off contacting a lender at all until after they found the perfect home. However, few home buyers enjoy the mortgage process as much as house shopping. Most people take their time with the house hunting phase when buying their dream home. In fact, the average home buying process in the U.S. takes about four months. However, if you want to avoid private mortgage insurance, you’ll need 20% down.

For example, in San Francisco — where median home prices are $1.54 million, according to CAR — the monthly mortgage payment on a median-priced home would be $7,787. When you’re ready to make an offer on a home in California, it’s important to recognize that buyers are getting an increasing amount of bargaining power here. While homes were selling for more than listing price during the peak of the pandemic-fueled real estate surge, those days are gone. That means that a home listed for $1,000,000 would actually go for closer to $960,000. With that in mind, consider offering less than the listing price as a starting point — your agent will help you land on a reasonable offer. It's important to point out that your credit score isn't the only factor that lenders consider during the underwriting process.

No comments:

Post a Comment